29+ kentucky paycheck calculator

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web The Kentucky Salary Calculator allows you to quickly calculate your salary after tax including Kentucky State Tax Federal State Tax Medicare Deductions Social Security.

Free Online Paycheck Calculator Calculate Take Home Pay 2023

Determine your filing status Step 2.

. Web Kentucky tax year starts from July 01 the year before to June 30 the current year. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

This income tax calculator can help estimate your. If you make 70000 a year living in Kentucky you will be taxed 11493. All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net.

The Kentucky minimum wage is 725 per hour. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income.

Web Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web How do I figure out how much my paycheck will be. Web How to Calculate Your Paycheck in Kentucky.

Web Kentucky paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Just enter the wages tax. Web The process is simple. Web Kentucky Income Tax Calculator 2022-2023.

Well do the math for youall you. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky. Your average tax rate is 1167 and your marginal.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. Web Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Net income Adjustments Adjusted gross income Step 3. Are you a resident of Kentucky and want to know how much take-home pay you can expect on each of your paychecks.

For example if an employee earns 1500 per week the.

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

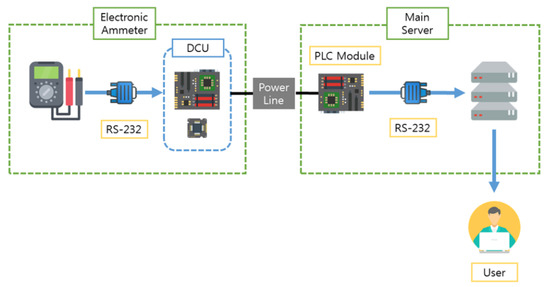

Sustainability Free Full Text Decrepit Building Monitoring Solution For Zero Energy Building Management Using Plc And Android Application

Paycheck Calculator Kentucky Ky 2023 Hourly Salary

Kentucky Salary Calculator 2023 Icalculator

Pdf Teoria De Numeros Ml Ci Academia Edu

Kentucky Hourly Paycheck Calculator Gusto

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Markets Insider

Colonial Village Apartments 715 Meadow Wood Drive Crescent Springs Ky Rentcafe

August 2021 Baltimore Beacon By The Beacon Newspapers Issuu

Gardner Lowe Aviation Services 2019 Product Catalog By M T Issuu

29 Killer Resources To Learn Copywriting Business 2 Community

New Tax Law Take Home Pay Calculator For 75 000 Salary

Kentucky Paycheck Calculator Smartasset

![]()

Numerical Methods Initial Value Problems For Ordinary Differential Equations Easy And Uni Study Notes Numerical Methods In Engineering Docsity

Kentucky Paycheck Calculator 2022 2023

Introduce Yourself The College Solution

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee